defer capital gains tax canada

If the funds are left in the QOF for at least seven years the basis increases again to 15 of the deferred capital gains. You can cut your capital gains by incurring capital losses.

Kitces The Right Way To Prioritize Tax Preferenced Savings Strategies

Individuals other than trusts may defer capital gains incurred on certain small business investments disposed of in 2021.

. Defer capital gains You can defer paying capital gains tax for your shares only when you got them from a spouse or parent due to death or divorce. This deferral applies to dispositions where you use the proceeds to acquire another small business investment. E is the proceeds of disposition and D is the lesser of E.

If the funds are left in the QOF for at least five years the basis increases to 10 of the deferred gain. No you cannot defer capital gains tax by selling your existing property and then buying another property within 3 months of the sale. For dispositions in 2021 report the total capital gain on lines 13199 and 13200 of Schedule 3 and the capital gains deferral on line 16100 of Schedule 3.

Claim a capital gains reserve If you sell an asset at a profit its possible to spread the capital gain over a period as long as five years if. In other words 10 of the original gain is tax-free. 1972 - it started with a 50 Inclusion Rate and all prior capital gains were exempted.

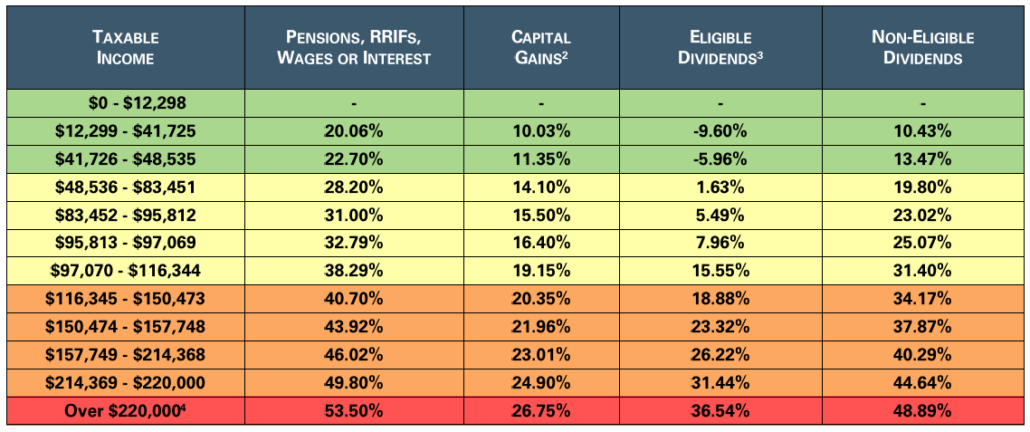

Section 44 applies to a property that. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital gains inclusion rate. 1988 - the Inclusion Rate was increased from 50 to 6667.

With 1031 Exchange Section 1031 of the Internal Revenue Code you can defer paying capital gains tax on rental property sales if you wish to purchase another property within that period. Canada does not have capital gains tax deferral rules like the US does 1031 exchange. The taxable portion of 125000 250000 capital gain x 50 inclusion rate is taxed at your marginal tax rate.

E the proceeds of disposition. Thus 15 of the original gain is tax-free. The 1031 Exchange is the holy grail of tax deferral opportunities.

The Canadian Chamber of Commerce recommends that the federal government. Capital gains deferral B D E where B is the total capital gain from the original sale. B the total capital gain from the original sale.

In fact you can walk away with an amount equal to 935 of your net sales proceeds tax deferred. D E or the total cost of all replacement shares whichever is less. 1990 the Inclusion Rate was increased again to 75.

The Rollover of Gain on Sale of Principal Residence rule has been replaced by a rule that allows individual taxpayers to fully exclude up to 250000 in capital gains from the sale of a principal residence and 500000 for a married couple filing jointly. Your income tax rate bracket is determined by your net income which is your gross income less any contributions to registered investment accounts. January 1 2022 is the 50th anniversary of the capital gains tax.

So if your spouse bought 100 shares of ABC stock and then transferred them to you in the divorce neither of you will have to pay capital gains tax on it at that time. Capital gains deferral for investment in small business. The adjusted cost base ACB of the new investment is reduced by the.

I Has been stolen destroyed or expropriated often referred to as an involuntary dispositionor. You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be able to cash out of the fund 100 tax free. In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44 or 441 of the Act.

It allows investors to defer 100 of their capital gains taxes as long as they reinvest their sales proceeds into a like kind property the replacement property which is why this transaction is sometimes referred to as a like kind exchange. Typically when you sell a property for a higher price than the base cost usually the purchase cost plus selling and other outlay costs you will have a capital gain on your property sale. Capital gains deferral B D E where.

A Brief History of the Capital Gains Tax in Canada. There is a way to accomplish the sale of an asset you own that has grown in value so that you not only defer your capital gains tax for many years but you also exit with cash equivalent to most of the sales proceeds. Deferral election is not taken but can claim CCA Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly sell the property.

In a nutshell you defer taxes then reduce then you eliminate them. A 100000 capital gain for someone with 75000 of other income in Ontario will generate about 18930 of tax payableunder 19. While Canadians do not have the liberty to defer taxes on property sale using the 1031 exchange the CRA allows capital gains tax deferral through a capital gains reserve.

And in Quebec someone with 150000 of income will pay about. How Do I Avoid Capital Gains Tax On Rental Property In Canada. Create a tax and regulatory environment that promotes the building of new affordable housing by allowing investors to defer CCA recapture and capital gains on the proceeds from the sale of rental property when the proceeds are reinvested in another rental property within a reasonable.

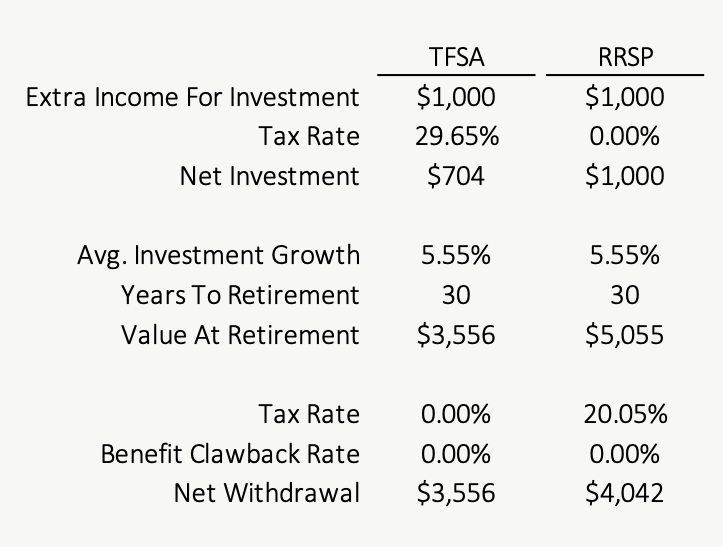

Tax Deferral Is Not Necessarily An Advantage Planeasy

How To Avoid Capital Gains Tax In Canada Remitbee

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

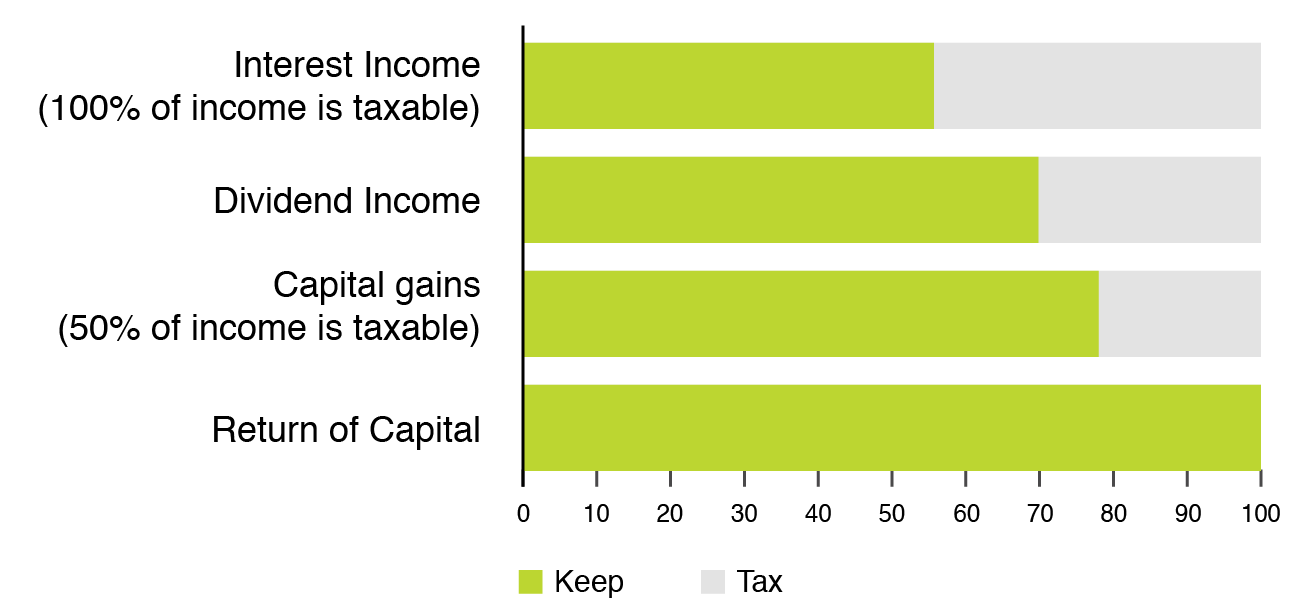

Starlight Capital Tax Treatment Of Distributions

Taxation For Capital Gains Capital Gains Reserve For Future Proceeds

I Know That Your Sweet Love For The Loonie Hasn T Died Tax Returns Is Always On Your Mind Www Ecotax4u Com Tax Return Tax Services Brampton

Hiring A World Class Tax Professional The Wealthy Accountant Finance Blog Money Saving Advice Mr Money Mustache

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

5 Categories Of Tax Planning Alitis Investment Counsel

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Vrbo Or Home Away Versus Airbnb Genymoney Ca Personal Finance Bloggers Money Saving Mom Personal Finance Lessons

6 Ways To Avoid Capital Gains Tax In Canada Reduce Capital Gains Tax Canada Youtube

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

How To Avoid Capital Gains Tax In Canada Remitbee

Defer Capital Gains Tax When To Pay Taxes Manning Elliott

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Tax On Real Estate Sales In Canada Madan Cpa

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen